Cellulose ether is a kind of natural polymer derived material, which has the characteristics of emulsification and suspension. Among the many types, HPMC is the one with the highest output and the most widely used, and its output is increasing rapidly.

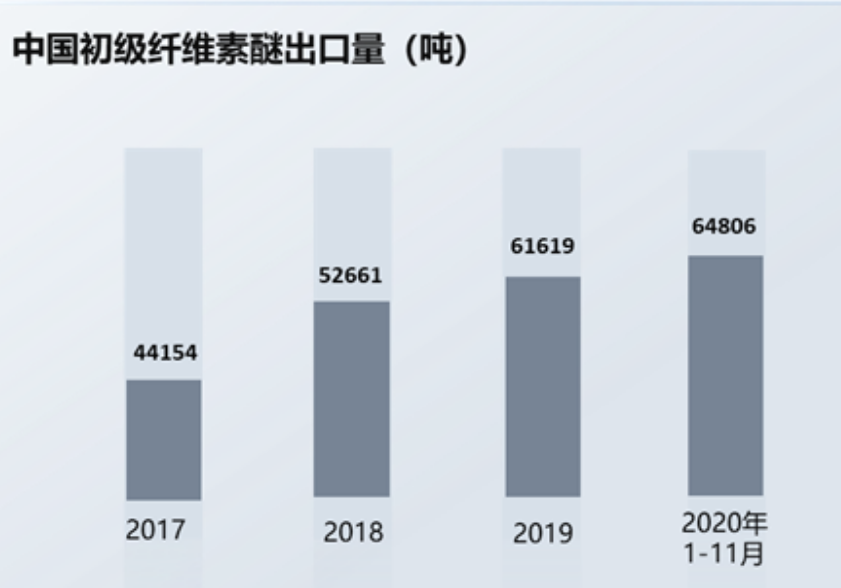

In recent years, thanks to the growth of the national economy, the production of cellulose ether in my country has increased year by year. At the same time, with the development of domestic science and technology, high-end cellulose ethers that originally required a large amount of imports are now gradually localized, and the export volume of domestic cellulose ethers continues to increase. Data show that from January to November 2020, China’s cellulose ether exports reached 64,806 tons, a year-on-year increase of 14.2%, higher than the export volume for the whole of 2019.

Cellulose ether is affected by upstream cotton prices:

The main raw materials of cellulose ether include agricultural and forestry products including refined cotton and chemical products including propylene oxide. The raw material of refined cotton is cotton linters. my country has abundant cotton production, and the production areas of cotton linters are mainly concentrated in Shandong, Xinjiang, Hebei, Jiangsu and other places. Cotton linters are very plentiful and in plentiful supply.

Cotton occupies a relatively large proportion in the commodity agricultural economic structure, and its price is affected by many aspects such as natural conditions and international supply and demand. Similarly, chemical products such as propylene oxide and methyl chloride are also affected by international crude oil prices. Since raw materials account for a large proportion in the cost structure of cellulose ether, fluctuations in raw material prices directly affect the sales price of cellulose ether.

In response to cost pressure, cellulose ether manufacturers often transfer the pressure to downstream industries, but the transfer effect is affected by the complexity of technical products, product diversity and product cost added value. Usually, enterprises with high technical barriers, rich product categories, and high added value have greater advantages, and enterprises will maintain a relatively stable level of gross profit; otherwise, enterprises need to face greater cost pressure. In addition, if the external environment is unstable and the range of product fluctuations is large, upstream raw material companies are more willing to choose downstream customers with large production scale and strong comprehensive strength to ensure timely economic benefits and reduce risks. Therefore, this limits the development of small-scale cellulose ether enterprises to a certain extent.

Downstream Market Structure:

With the continuous advancement of science and technology, the downstream demand market will grow accordingly. At the same time, the scope of downstream applications is expected to continue to expand, and downstream demand will maintain steady growth. In the downstream market structure of cellulose ether, building materials, oil exploration, food and other fields occupy a major position. Among them, the building materials sector is the largest consumer market, accounting for more than 30%.

The construction industry is the largest consumer field of HPMC products:

In the construction industry, HPMC products play an important role in bonding and water retention. After mixing a small amount of HPMC with cement mortar, it can increase the viscosity, tensile and shear strength of cement mortar, mortar, binder, etc., thereby improving the performance of building materials, improving construction quality and mechanical construction efficiency. In addition, HPMC is also an important retarder for the production and transportation of commercial concrete, which can lock water and enhance the rheology of concrete. At present, HPMC is the main cellulose ether product used in building sealing materials.

The construction industry is a key pillar industry of my country’s national economy. The data shows that the construction area of housing construction has increased from 7.08 billion square meters in 2010 to 14.42 billion square meters in 2019, which has strongly stimulated the growth of the cellulose ether market.

The overall prosperity of the real estate industry has rebounded, and the construction and sales area have increased year-on-year. Public data shows that in 2020, the monthly year-on-year decline in the new construction area of commercial residential housing has been narrowing, and the year-on-year decrease has been 1.87%. In 2021, the recovery trend is expected to continue. From January to February this year, the growth rate of the sales area of commercial housing and residential buildings rebounded to 104.9%, which is a considerable increase.

Oil Drilling:

The drilling engineering services industry market is particularly impacted by global exploration and development investments, with approximately 40% of the global exploration portfolio devoted to drilling engineering services.

During oil drilling, drilling fluid plays an important role in carrying and suspending cuttings, strengthening hole walls and balancing formation pressure, cooling and lubricating drill bits, and transmitting hydrodynamic force. Therefore, in oil drilling work, it is very important to maintain proper humidity, viscosity, fluidity and other indicators of drilling fluid. The polyanionic cellulose, PAC, can thicken, lubricate the drill bit, and transmit hydrodynamic force. Due to the complex geological conditions in the oil storage area and the difficulty of drilling, there is a large demand for PAC.

Pharmaceutical accessories industry:

Nonionic cellulose ethers are widely used in the pharmaceutical industry as pharmaceutical excipients such as thickeners, dispersants, emulsifiers and film formers. It is used for film coating and adhesive of pharmaceutical tablets, and can also be used for suspensions, ophthalmic preparations, floating tablets, etc. Since pharmaceutical grade cellulose ether has stricter requirements on the purity and viscosity of the product, the manufacturing process is relatively complicated and there are more washing procedures. Compared with other grades of cellulose ether products, the collection rate is lower and the production cost is higher, but the added value of the product is also higher. Pharmaceutical excipients are mainly used in preparation products such as chemical preparations, Chinese patent medicines and biochemical products.

Due to the late start of my country’s pharmaceutical excipients industry, the current overall development level is low, and the industry mechanism needs to be further improved. In the output value of domestic pharmaceutical preparations, the output value of domestic medicinal dressings accounts for a relatively low proportion of 2% to 3%, which is far lower than the proportion of foreign pharmaceutical excipients, which is about 15%. It can be seen that domestic pharmaceutical excipients still have a lot of room for development., It is expected to effectively stimulate the growth of the related cellulose ether market.

From the perspective of domestic cellulose ether production, Shandong Head has the largest production capacity, accounting for 12.5% of the total production capacity, followed by Shandong RUITAI, Shandong YITENG, North TIANPU Chemical and other enterprises. Overall, the competition in the industry is fierce, and the concentration is expected to further increase.

Post time: Mar-29-2023